Examine This Report about Property By Helander Llc

Examine This Report about Property By Helander Llc

Blog Article

How Property By Helander Llc can Save You Time, Stress, and Money.

Table of Contents3 Easy Facts About Property By Helander Llc ExplainedThe Best Strategy To Use For Property By Helander LlcSome Known Factual Statements About Property By Helander Llc How Property By Helander Llc can Save You Time, Stress, and Money.9 Easy Facts About Property By Helander Llc Explained3 Simple Techniques For Property By Helander Llc

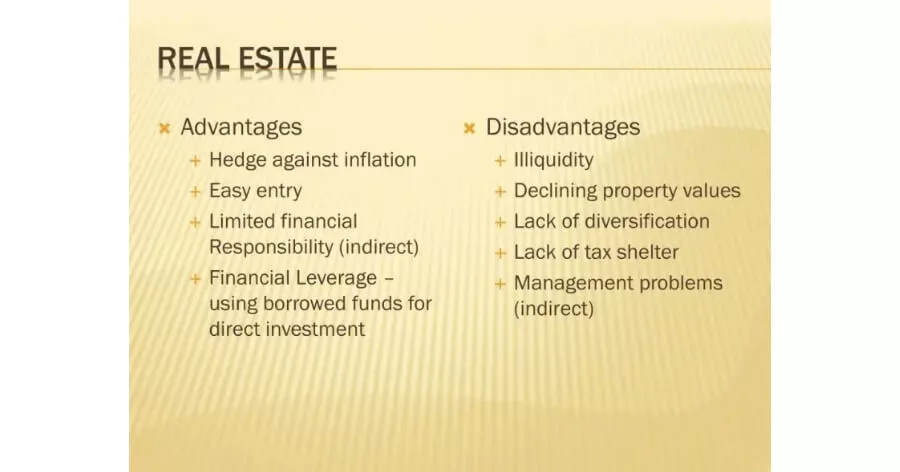

The advantages of buying realty are countless. With well-chosen properties, investors can appreciate foreseeable capital, excellent returns, tax advantages, and diversificationand it's possible to take advantage of realty to build wealth. Assuming about investing in realty? Here's what you need to recognize about realty advantages and why realty is considered a good financial investment.The benefits of spending in actual estate consist of easy earnings, secure money circulation, tax obligation benefits, diversification, and utilize. Real estate financial investment counts on (REITs) supply a way to invest in genuine estate without having to own, operate, or money homes.

In most cases, cash money circulation only reinforces gradually as you pay down your mortgageand develop your equity. Actual estate investors can capitalize on many tax obligation breaks and reductions that can conserve money at tax time. In basic, you can subtract the affordable prices of owning, operating, and handling a property.

Property By Helander Llc for Dummies

Realty worths often tend to increase in time, and with a great investment, you can make a profit when it's time to offer. Leas also often tend to climb with time, which can bring about greater capital. This graph from the Federal Get Bank of St. Louis shows average home prices in the united state

The areas shaded in grey indicate united state economic crises. Mean Sales Cost of Homes Cost the USA. As you pay down a residential or commercial property mortgage, you develop equityan asset that belongs to your web worth. And as you build equity, you have the utilize to buy even more residential or commercial properties and increase capital and wealth much more.

Due to the fact that genuine estate is a concrete possession and one that can act as security, funding is easily available. Property returns differ, depending on variables such as area, property class, and administration. Still, a number that numerous financiers go for is to beat the average returns of the S&P 500what numerous people refer to when they claim, "the market." The inflation hedging capability of realty comes from the positive connection between GDP growth and the need for actual estate.

The Best Strategy To Use For Property By Helander Llc

This, in turn, converts right into greater funding values. Genuine estate has a tendency to keep the purchasing power of funding by passing some of the inflationary stress on to occupants and straight from the source by including some of the inflationary stress in the kind of resources appreciation - realtors sandpoint idaho.

Indirect genuine estate spending entails no direct possession of a residential or commercial property or residential or commercial properties. There are several methods that owning genuine estate can protect versus inflation.

Finally, residential or commercial properties financed with a fixed-rate loan will see the loved one quantity of the monthly home loan settlements tip over time-- for example $1,000 a month as a fixed repayment will certainly become less difficult as rising cost of living erodes the purchasing power of that $1,000. Often, a primary house is not taken into consideration to be a genuine estate investment given that it is utilized as one's home

All About Property By Helander Llc

Also with the aid of a broker, it can take a couple of weeks of work just to find the right counterparty. Still, realty is a distinctive asset class that's basic to comprehend and can enhance the risk-and-return account of a capitalist's portfolio. On its own, realty offers capital, tax obligation breaks, equity structure, competitive risk-adjusted returns, and a bush against rising cost of living.

Buying property can be an extremely satisfying and profitable endeavor, yet if you resemble a great deal of new investors, you might be wondering WHY you must be purchasing property and what advantages it brings over other financial investment chances. Along with all the remarkable advantages that go along with buying property, there are some downsides you require to take into consideration also.

Not known Details About Property By Helander Llc

If you're looking for a means to acquire right into the real estate market without having to spend hundreds of thousands of dollars, look into our homes. At BuyProperly, we make use of a fractional possession version that enables financiers to start with as low as $2500. An additional significant benefit of property investing is the capability to make a high return from acquiring, restoring, and reselling (a.k.a.

Excitement About Property By Helander Llc

As an example, if you are charging $2,000 rental fee each month and you incurred $1,500 in tax-deductible expenditures monthly, you will just be paying tax obligation on that particular $500 profit each month. That's a large difference from paying taxes on $2,000 per month. The profit that you make on your rental for the year is taken into consideration rental income and will certainly be tired accordingly

Report this page